how much taxes are taken out of paycheck in michigan

Individuals who earned less than 200000 in 2021 will. Assuming a top tax rate of 37 heres a look at how much youd take home after taxes in each state and Washington DC if you won the 19 billion jackpot for both the lump.

Paycheck Tax Withholding Calculator For W 4 Tax Planning

See if you Qualify for IRS Fresh Start Request Online.

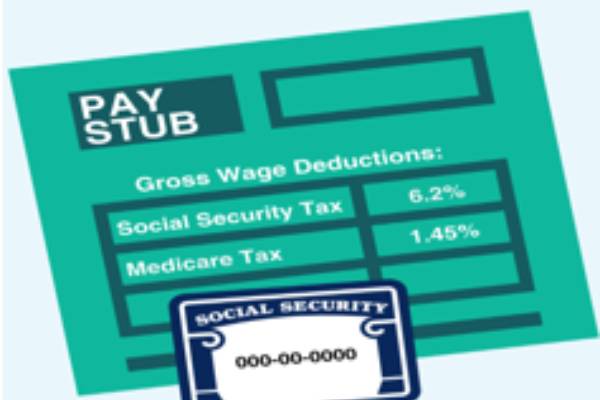

. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Supports hourly salary income and multiple pay frequencies. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan.

You pay unemployment tax. The Powerball jackpot is a record 204 billion. Use the paycheck calculator to see the Michigan taxes that.

For a single employee paid weekly with taxable income of 500 the federal income tax in 2019 is 1870 plus 12 percent of the. November 7 2022 657 AM PST. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same.

While the 24 federal tax. Maximum Tax Rate for 2021 is 631 percent. Just enter the wages tax withholdings and other information required.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The state tax year is also 12 months but it differs from state to state. Owe IRS 10K-110K Back Taxes Check Eligibility.

Local income tax ranging from 1 to 24. This free easy to use payroll calculator will calculate your take home pay. What taxes are taken out of a paycheck in Texas 2021.

Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The income tax is a flat rate of 425. Hourly Salary After Taxes.

How much tax is taken out of a 500 check. Established by the federal government under IRC section 3121 the Federal Insurance Contributions Act requires all businesses to deduct federal taxes from each paycheck. If the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes.

How You Can Affect Your Michigan Paycheck. Use the paycheck calculator to see the michigan taxes that will be withheld from your paycheck. Michigan tax year starts from.

Fica taxes consist of social security and medicare taxes. The income tax is a flat rate of 425. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of. Some states follow the federal tax year some. Able to claim exemptions.

No state-level payroll tax. How Much Money Gets Taken Out of Your Paycheck. Ad Owe back tax 10K-200K.

Lets say you got a new job that pays 20hour. That works out to 800 per week 3200 per month and 41600 per year--pretax. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional.

Winners will be hit with a massive tax bill if they live in these states. Take Home Paycheck Calculator. Minimum Tax Rate for 2021 is 031 percent.

The employer portion is 15 percent and the. This Michigan hourly paycheck. Employers must report new or rehired employees within 20 days of hire through the Michigan New Hires Operation Center.

On 10200 in jobless benefits. Michigan allows employers to pay. The Michigan bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Illinois 183 billion relief package includes income and property tax rebates that should be going out through November.

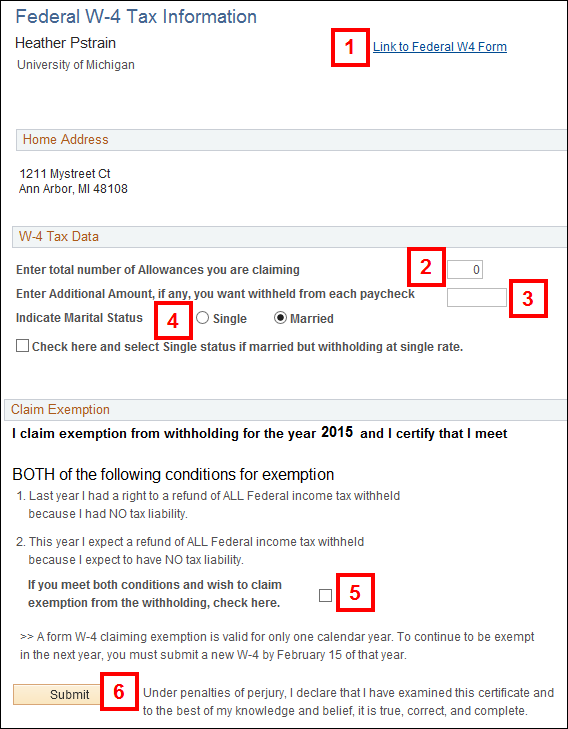

Help Federal W 4 Tax Information

Michigan Income Tax Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Michigan Tax Return Form Mi 1040 Can Be Efiled For 2022

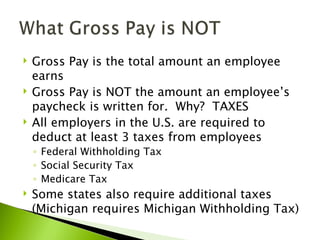

They Took What Your First Paycheck And Taxes 4 H Youth Money Management

A Complete Guide To Michigan Payroll Taxes

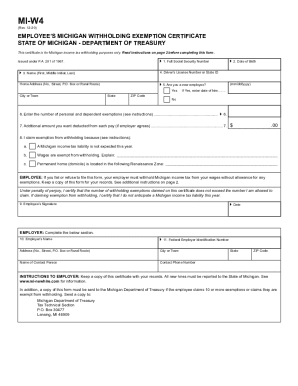

Mi Mi W4 2020 2022 Fill Out Tax Template Online

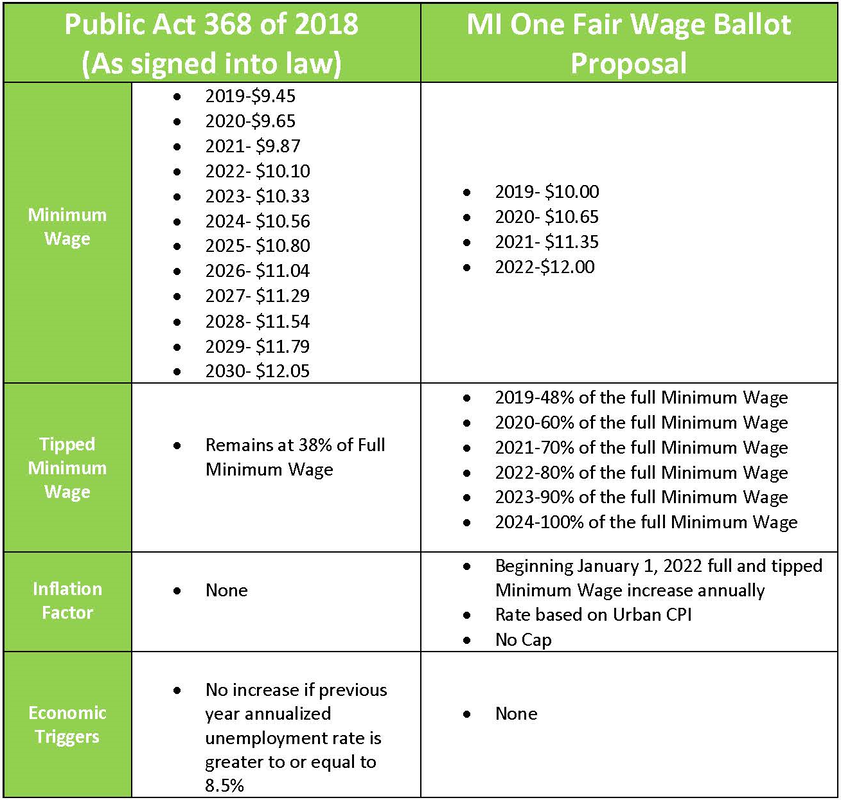

Minimum Wage Michigan Restaurant Lodging Association

Gop Income Tax Reform Would Be Nail In Coffin For Michigan Cities Some Say Bridge Michigan

New Tax Law Take Home Pay Calculator For 75 000 Salary

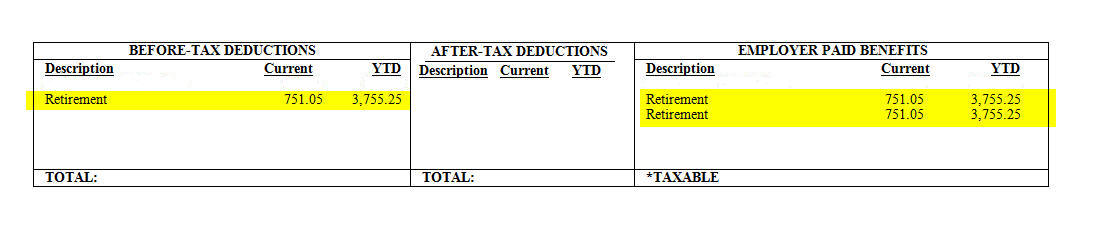

Understanding Your Paycheck Human Resources University Of Michigan

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

How To Read Your Paycheck Stub Clearpoint

Llc Tax Calculator Definitive Small Business Tax Estimator

This Bill Could Make Social Security Taxes Could Be A Thing Of The Past

I Worked From Home For A Significant Portion Of The Year But Continued To Pay Detroit City Taxes Can I Submit A Days Not Worked In City Exemption Through Turbotax