michigan use tax exemptions

The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing.

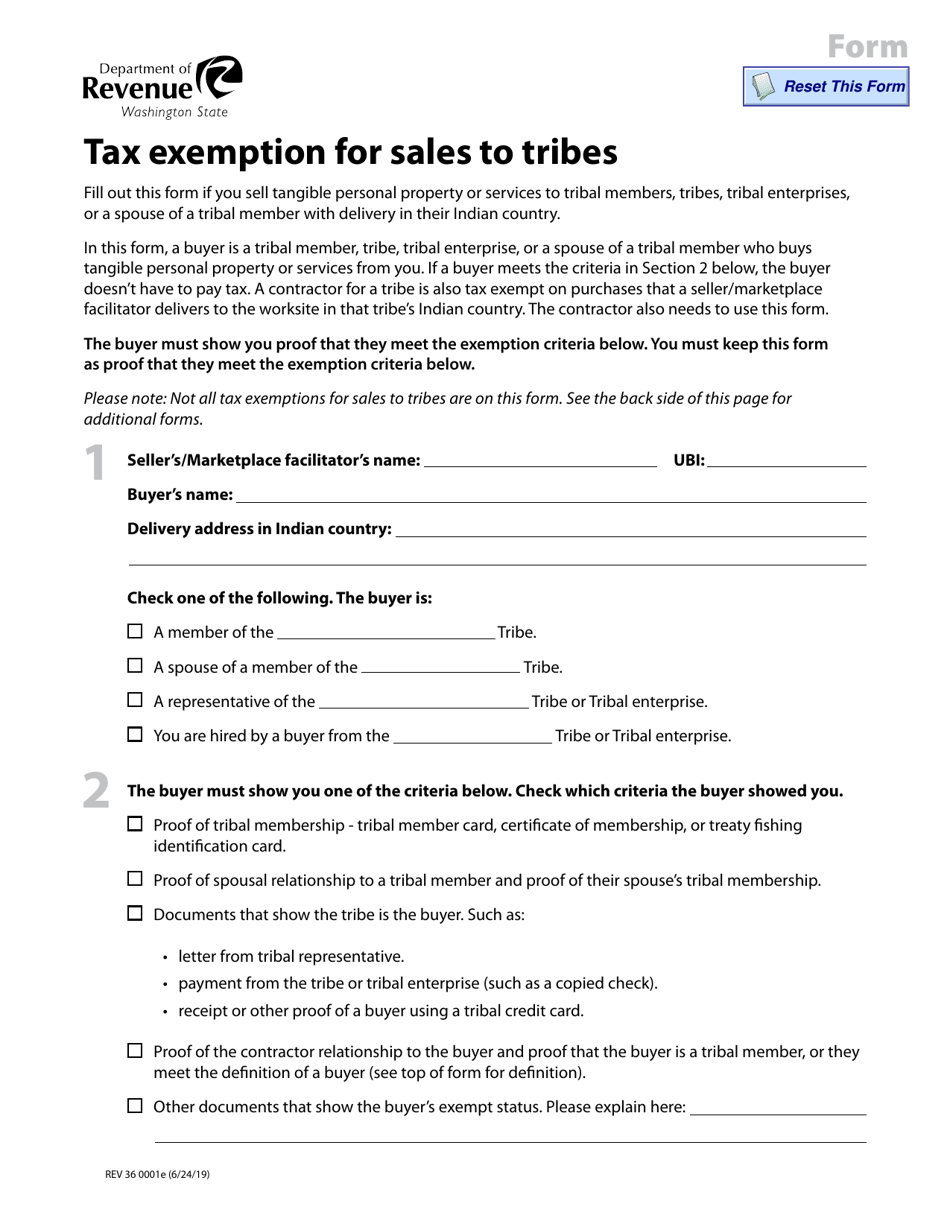

Form Rev36 0001e Download Fillable Pdf Or Fill Online Tax Exemption For Sales To Tribes Washington Templateroller

There are no local sales taxes in the state of Michigan.

. The People of the State of Michigan enact. Use tax is also. The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate.

Amends 1893 PA 206 MCL 2111 -. Use tax of 6 percent must be paid on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases by mail from out-of-state retailers. Michigan Sales and Use Tax Contractor Eligibility Statement.

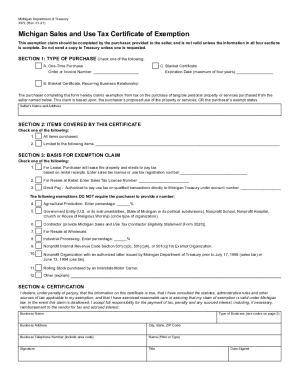

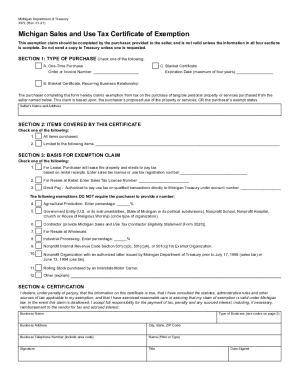

Adjourned until Tuesday May 24 2022 100000 AM. Michigan Sales and Use Tax Certificate of Exemption. Michigan defines industrial processing as the activity of converting or.

This act may be cited as the Use Tax Act. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 2020 Sales Use and.

For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425 percent and the personal exemption is 4900 for each taxpayer and dependent. 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Several examples of exemptions to the. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals.

The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. History1937 Act 94 Eff. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. Michigan Sales and Use Tax Certificate of Exemption Form 3372 Multistate Tax Commissions Uniform Sales and Use Tax Certificate. IRA and Roth IRA up to 1512350.

Ad Fill Sign Email MI Form 5076 More Fillable Forms Register and Subscribe Now. Michigan Department of Treasury 5082 Rev. Sales Tax Return for Special Events.

The following exemptions DO NOT require the purchaser to provide a number. In order to be exempt from Michigan sales or use tax certain criteria must be met. 10-19 Page 1 of 2 Issued under authority of Public Acts 167 of 1933 94 of 1937 and 281 of 1967 all as amended.

How do I claim a valid exemption with my supplier. Michigan Compiled Laws Complete Through PA 76 of 2022 House. 20591 Use tax act.

Sales and Use Tax Exemption for Transformational Brownfield Plans. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax. All fields must be.

SALES AND USE TAX EXEMPTIONS AND REQUIREMENTS Replaces Revenue Administrative Bulletin 1996-6 for Periods On or After June 29 2000 RAB 2002-15. Church Government Entity Nonprot School or Nonprot. Michigan HB6090 2021-2022 Property tax.

Adjourned until Tuesday May 24 2022 13000 PM Senate. However if provided to the purchaser in electronic. Thursday June 10 2021.

Freeze of taxable value for primary residences of certain senior citizens. Exemption is allowed in Michigan on the sale of rolling stock purchased by an interstate motor carrier or for. If you decide to use Michigans state exemptions you can also use the federal nonbankruptcy exemptions.

Sales Tax Exemptions in Michigan.

Sales And Use Tax Regulations Article 3

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

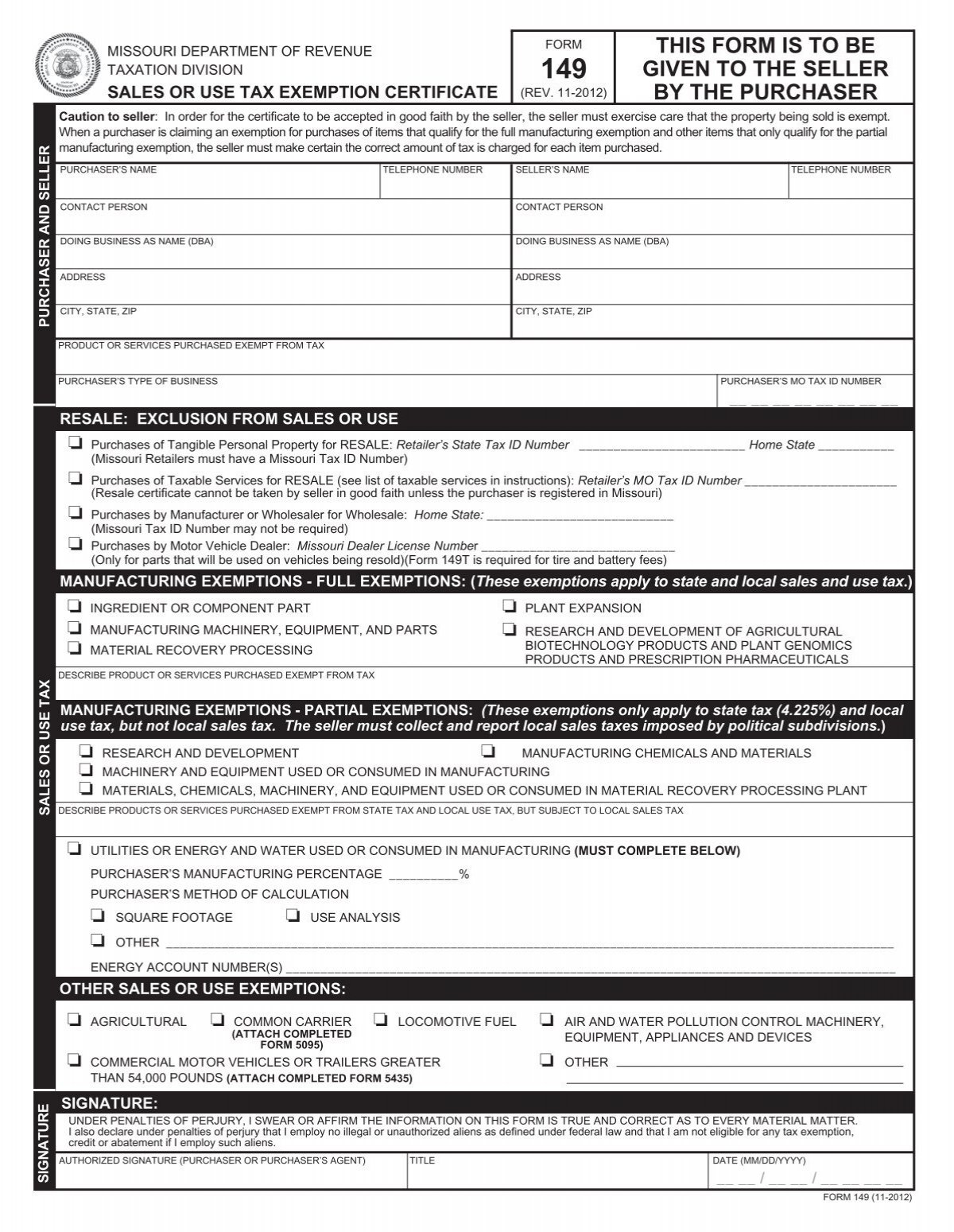

Form 149 Sales And Use Tax Exemption Certificate Missouri

Michigan Sales Tax Exemptions Agile Consulting Group

Michigan Sales Tax Exemptions Agile Consulting Group

Resale Certificate Michigan Fill Out And Sign Printable Pdf Template Signnow

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

Download Policy Brief Template 40 Brief Policies Executive Summary

Michigan Sales Tax Small Business Guide Truic

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Deductions

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller