arizona estate tax return

The annual exclusion for gift taxes remains at 14000. But there are states that do impose a state-level estate tax.

Complete Your 2021 Arizona And Irs Taxes Now On Efile Com

Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return.

. Arizona Estate Tax Return. You would receive 950000. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

But that doesnt leave you exempt from a. If you own property in other states some states have their estate or inheritance tax. Your Arizona State Income Taxes for Tax Year 2021 January 1 - Dec.

Please review the information. You would pay 95000 10 in inheritance taxes. Ad Register and Edit Fill Sign Now your AZ DoR Form 301 more fillable forms.

We cannot provide a status at this time. There are no inheritance taxes or estate taxes in Arizona. Thank you for your inquiry.

The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The estate and gift tax exclusion amounts were increased to 5450000. Form is used by a Fiduciary who electronically files an estate or trusts tax return Form 141AZ and is separately mailing.

Several of our CPAs are members of the Southern. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. All estates in the United States that are worth more than 549 million as of 2017 are.

Federal law eliminated the state death tax credit effective January 1 2005. 14 rows Arizona Fiduciary Income Tax Return. Arizona state income tax rates range from 259 to 450.

Complete and mail to. If you own property in those states or have. 31 2021 can be prepared and e-Filed now along with your Federal or IRS Income Tax Return or you can.

Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following. Create Legally Binding Electronic Signatures on Any Device. While the estate tax is not an inheritance tax as it is paid to the federal government by the estate and not the heirs such a tax can reduce the amount of money heirs receive.

Click here to view other state estate and inheritance taxes. If you have submitted your. Additionally the trust must file a Form 1041 which reports income capital gains deductions and losses.

2017 Estate and Gift Tax. With this document the trust can deduct interest it distributes to beneficiaries from its. We complete over 600 trust returns Form 1041 on behalf of clients every year and we do 5 to 10 estate tax returns Form 706 annually.

The value of the estate exceeds 20000 at time of death. 20 rows Arizona Fiduciary Income Tax Return Income tax return filed by a. The estate has a beneficiary that is not an Arizona resident.

Arizona Estate Tax. If it is incorrect click New Search. The estate would pay 50000 5 in estate taxes.

First Arizona does not have its own estate tax. Arizona Estate or Trust Income Tax Payment Voucher. Residents and nonresidents owning property there can rejoice.

For estates of resident and nonresident decedents with date of death on or after January 1 1980. 2016 Estate and Gift Tax Law Changes. If an estate is worth 15 million 36 million is taxed at 40 percent.

If needed the personal representative should request the tax release. As of 2006 Arizona no longer levies an estate tax.

Property Taxes 101 Redfin Homeowner Taxes Estate Tax Property Tax

What S The Arizona Tax Rate Credit Karma Tax

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Business Perspective Income Tax

Hitting The Market Thursday Want To See It Today Move In Ready New Carpet Call Me Text Me 602 758 7135 New Carpet Arizona Real Estate Home Buying

Scottsdale Mansion Sells For 24 1m Shatters Arizona Price Record Ktar Com Mansions Scottsdale Arizona

Life After Retirement Require S The Right House First Time Home Buyers Home Buying Buying Your First Home

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

Arizona State Taxes 2022 Tax Season Forbes Advisor

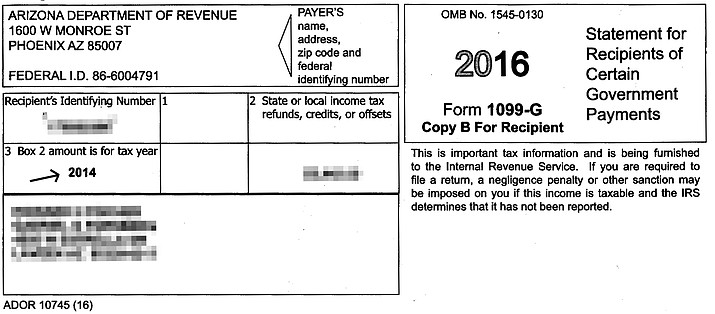

Hold Up On Doing Your Taxes Arizona Tax Form 1099 G Is Flawed The Verde Independent Cottonwood Az

Will And Testament Template Free Printable Documents Last Will And Testament Will And Testament Estate Planning Checklist

Caring Transitions Of Southern Arizona Logo Online Estate Sales Caring Estate Sale